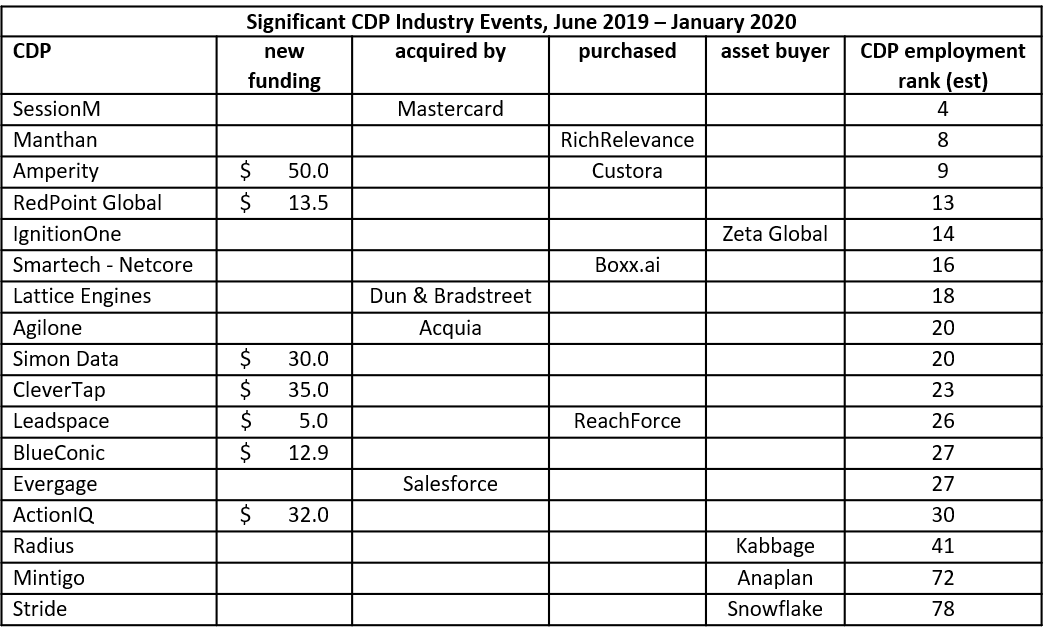

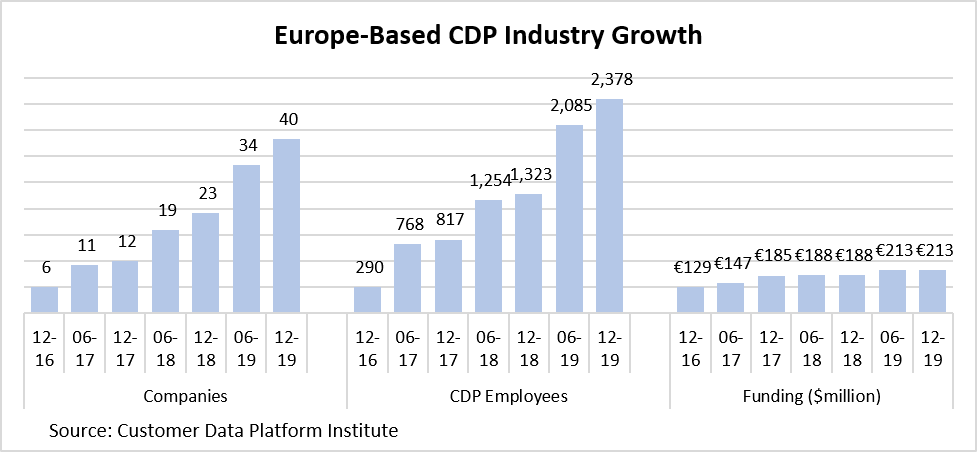

SWARTHMORE, PA, U.S.A., 9-Mar-2020 — /EPR INTERNET NEWS/ — Europe’s base of home-grown Customer Data Platform vendors grew rapidly in 2019, according to the CDP Industry in Europe 2020 report from the Customer Data Platform Institute. The number of vendors grew by 73% and employment grew by 80% during the year. Estimated revenue for Europe-based firms reached €260 million.

The high growth came despite a near-total lack of outside funding for new CDP ventures. Only one Europe-based CDP announcing funding during 2019, for €10 million, compared with €450 million for eleven non-European vendors. One result is that European industry growth came primarily from established firms adding a CDP product, rather than new CDP start-ups. Another is that most European vendors are substantially smaller than their external counterparts and are more likely to serve a single national market.

The European industry remains highly fragmented, no single vendor exceeding 10% market share and the top five vendors combined accounting for one-third of total employment. A dozen European countries have at least one native CDP although the United Kingdom, France, and The Netherlands are home to half of all European CDP vendors and 60% of employment.

The report also lists non-European vendors with a presence in the European market. The CDP Institute estimates these firms earned €100 million in Europe in 2019 and will reach €135 in 2020. It expects that 2020 revenue for Europe-based CDP vendors will reach at least €350 million. Revenue may grow even more quickly as global software firms including Salesforce, Adobe, Oracle, Microsoft, and SAP start selling their own CDP products in Europe.

The new study also includes market-by-market analyses from local vendors. Their consensus is that buyers now have a clearer understanding of the value provided by CDPs. But vendors say that buyers are still cautious, with longer purchase cycles in Europe than other markets and relatively few completed implementations. They expect that sales to accelerate in 2020 as CDPs become increasingly familiar and global software vendors further educate the market.

A free copy of the complete CDP Industry in Europe 2020 report is available here. The CDP Institute’s latest global CDP Industry Update is available here.

SOURCE: EuropaWire